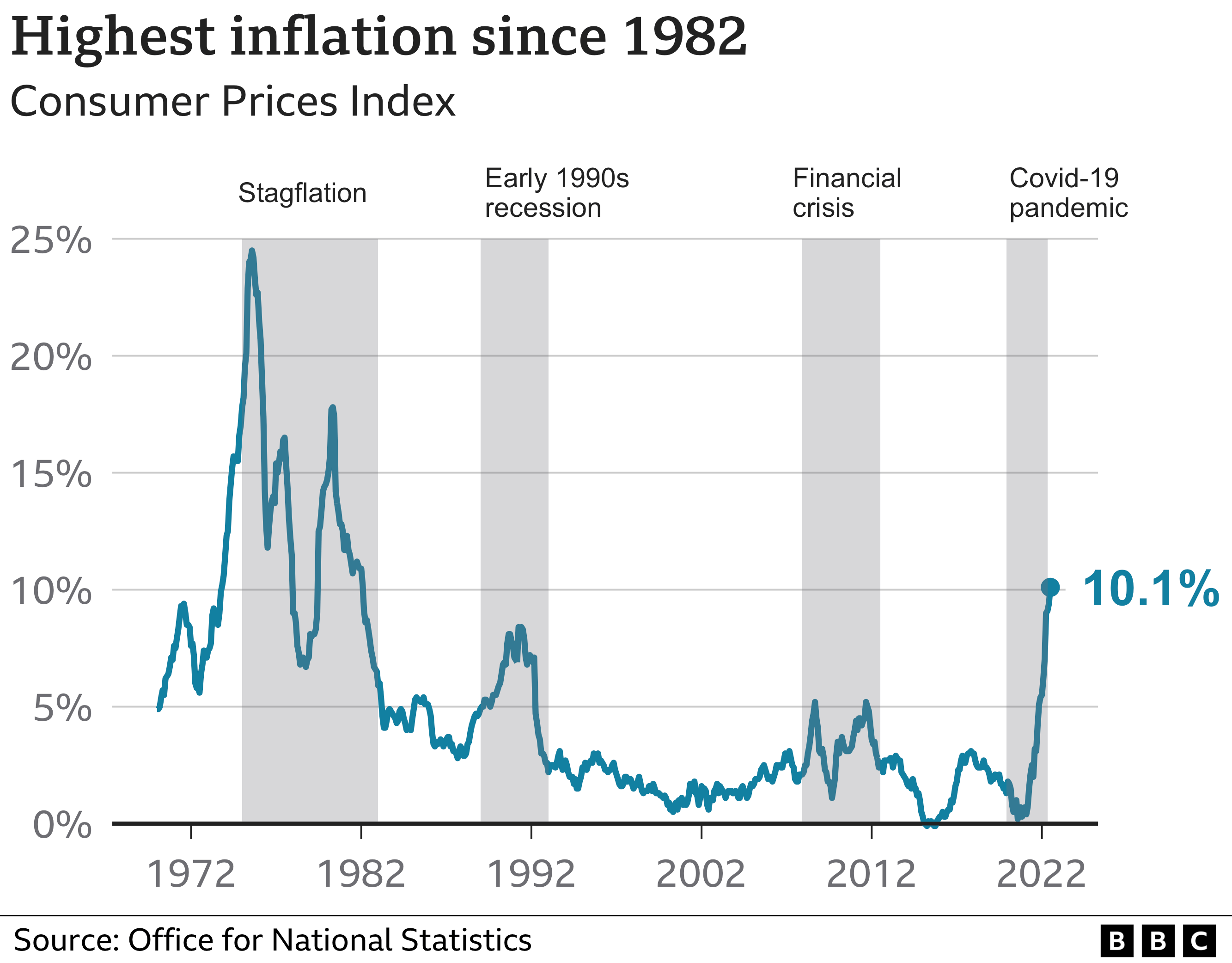

Soaring food costs have pushed UK inflation into double digits for the first time since 1982, with prices continuing to rise at their fastest rate for more than 40 years.

Inflation hit 10.1% in the 12 months to July, up from 9.4% in June, the Office for National Statistics (ONS) said.

Soaring living costs are eating into household budgets, with prices rising faster than wages.

The Bank of England has said inflation could peak at more than 13% this year.

Energy, petrol and diesel costs are also contributing to inflation. But food and non-alcoholic drinks were the largest contributor to rising prices in July, according to the ONS.

The price of bread, cereals, milk, cheese and eggs rose the fastest, while the cost of vegetables, meat and chocolate were also higher.

Prices also rose for other staples, such as toilet rolls, pet food and toothbrushes.

Transport costs were another big contributing factor, with air fares and international rail tickets particularly increasing. The price for package holidays also went up, as demand increased.

‘Everything has gone up in price’

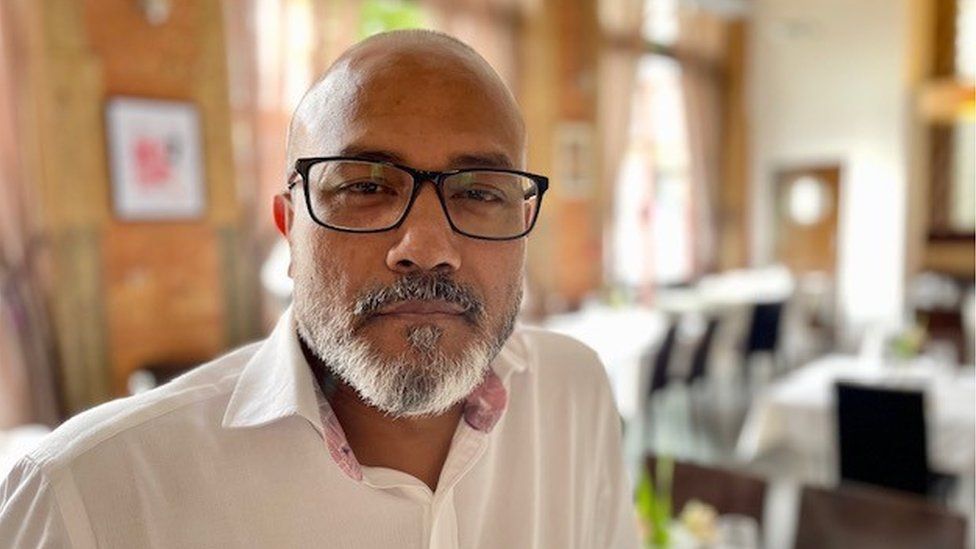

Restaurant owner Shaf Islam, who runs Chutney Ivy in Leicester, said the hospitality industry was facing huge cost increases.

“Everything’s gone up, from salt to soft drinks, rice to oil,” he told the BBC.

“My electricity bill is going up from £1,000 a month to £3,000,” he added.

He is reluctantly passing some of that extra cost on to customers.

“For the first time in five years, we’ve put up prices. I don’t like doing that because I know how tough it is for people,” he said.

IMAGE SOURCE,REBECCA BROWN

IMAGE SOURCE,REBECCA BROWNRebecca Brown, a full-time PhD student at the University of Nottingham, is worried about what will happen when her energy bills go up again this winter.

Her gas and electricity costs have already jumped from £80 to £140.

She tops up her student loan by working part-time and shares her living costs with her partner.

“After rent and bills plus my bus fare, phone, Netflix and Spotify bills, that leaves me around £300 to £400 a month for food, fun and necessities,” she said.

“Things like the dentist and getting my hair cut are pretty much a no-no, but my parents have helped out with that when I’ve gotten desperate.”

The rise in global food commodity prices, following Russia’s invasion of Ukraine, has been one of the factors pushing up prices at supermarket tills.

The war has disrupted supplies from the two countries, which are major exporters of goods such as sunflower oil and wheat.

Some commodities, especially grain and edible oils, have eased substantially, but there is typically a time lag of around six months before that feeds through to prices on the shelves.

Kien Tan, director of retail strategy at PwC, said: “Supermarkets have had little choice but to pass on price increases from suppliers, themselves contending with unprecedented inflation in raw material and ingredient input costs.

“This has been particularly acute in labour and utility intensive categories like dairy, with reports of the price of a pint of milk having more than doubled in some stores since the start of the year.”

While the Bank of England and others have forecast that inflation would exceed 10%, most economists didn’t expect it to happen just yet – with the consensus forecast at 9.8%.

Driving up the average rise between June and July were food prices – everything from bread and cereals, up by an annual 12.4%, to milk cheese and eggs, up 19.4%, to oils and fats, up 23.4%.

The causes are familiar: the reopening of the global economy post-pandemic, which meant the supply of goods like fuel couldn’t keep up with surging demand, made worse by the war in Ukraine, which further disrupted the supply of goods like gas, wheat and cooking oil.

That’s led to a surge in output prices – prices of goods at the factory gate – which rose by 17.1%, faster than they have since 1977.

The figures offer just a glimmer of hope from the petrol forecourts – where prices began to fall a little in July.

The inflation rate is expected to rise further in October, when higher energy bills hit.

The typical household energy bill is forecast to reach £3,582 in October and £4,266 in January, when the price cap – the maximum amount suppliers can charge customers in England, Scotland and Wales for each unit of energy – goes up again.

The Bank of England has warned the UK will fall into recession later this year, with the economy forecast to shrink in the last three months of 2022 and keep shrinking until the end of 2023.

The cost of living crisis will be among the biggest challenges facing the new prime minister in the autumn and leadership candidates Liz Truss and Rishi Sunak have clashed over what further support they would offer households.

Ms Truss, who is the favourite to win the race, has pledged to cut taxes but Mr Sunak has said this should only happen once inflation is under control.

Lord Stuart Rose, chairman of Asda and a Conservative peer, called for more action to help those most in need.

“We’ve been very, very slow in recognising this train coming down the tunnel. It’s now here, and it’s not about to run us over, it’s [already] run quite a lot of people over,” he told BBC Radio 4’s Today programme.

‘Top priority’

Chancellor Nadhim Zahawi said there were “no easy options” for the government in the face of soaring inflation.

However, he said the Treasury was preparing “all the options” on additional support for households ready for the incoming prime minister.

But Labour accused the Conservatives of “ignoring the scale of this crisis”.

Shadow Chancellor Rachel Reeves said: “We must get a grip on rising inflation leaving families worried sick about making ends meet.

“Labour’s fully-costed plan to freeze the energy price cap will bring inflation down this winter easing the burden on households and businesses.”