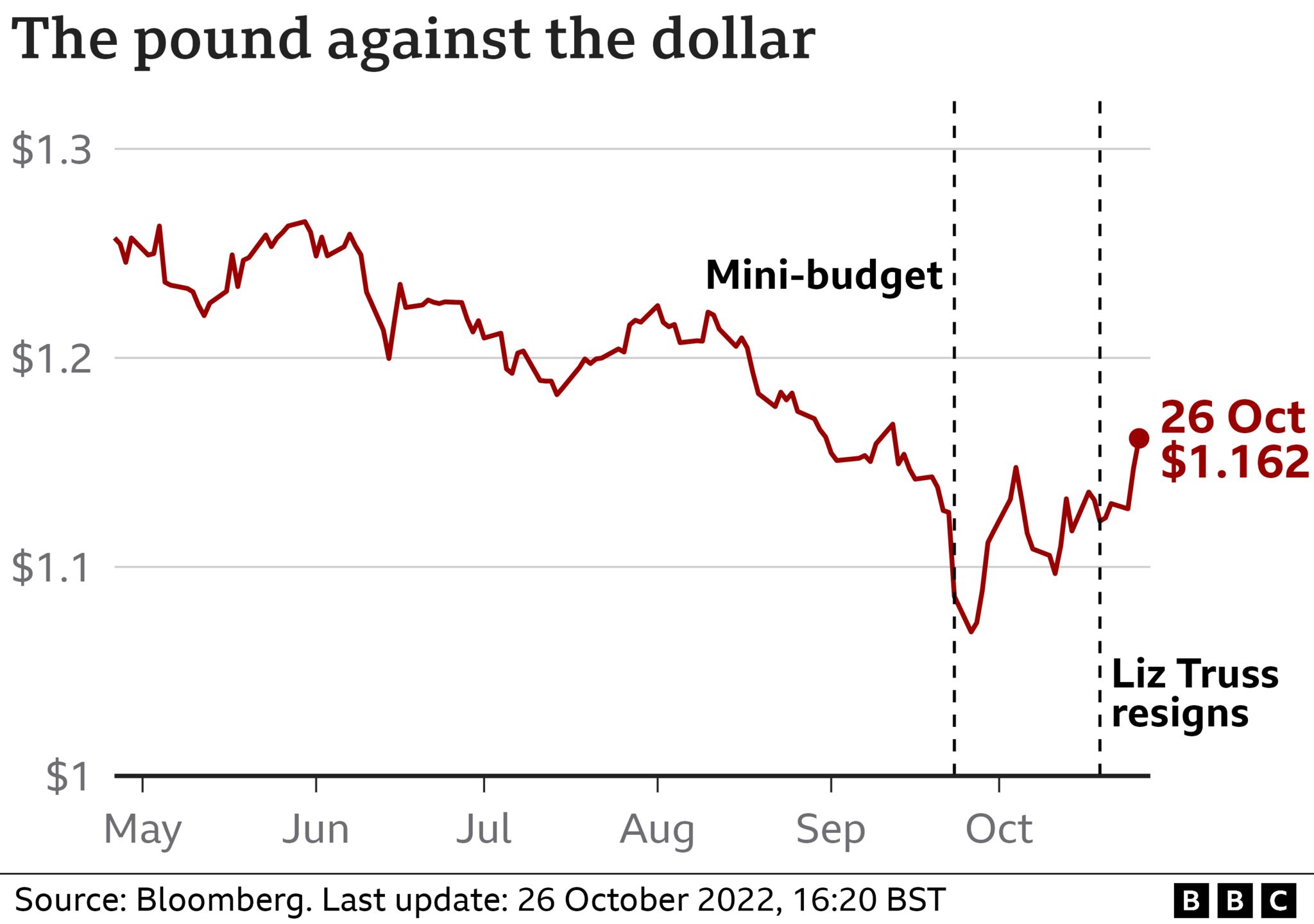

The pound has risen against the dollar after the economic plan was delayed until 17 November.

Sterling is currently trading at $1.16, up around 1.2% on the day.

The currency has rallied in recent days as investors welcomed the appointment of Rishi Sunak as prime minister and the dollar fell.

“The delay to the economic statement is disappointing but understandable,” said Jane Foley, a currency strategist at Rabobank.

“The markets have largely shrugged this off, because they understand we have a new chancellor, we have a new PM, and it’s quite likely that they do need a bit more time to nail things down and get these numbers right,” she said.

Financial markets had been rattled by fears over the economy in recent weeks.

Last month, sterling plunged to a record low against the dollar and government borrowing costs rose sharply in the aftermath of former Prime Minister Liz Truss’s mini-budget.

Investors were spooked after then-Chancellor Kwasi Kwarteng promised major tax cuts without saying how they would be paid for – something Mr Sunak had warned about during this summer’s Tory leadership contest.

But the cost of government borrowing has now fallen back to the level it was at before last month’s mini-budget.

The BBC’s economics editor Faisal Islam says this gives the new Chancellor, Jeremy Hunt, what insiders are calling “a dividend” – in other words, the government will now be spending billions of pounds less on debt costs.

Mr Sunak, a former hedge fund manager, is seen as a safer pair of hands by investors and has pledged to fix “mistakes” made under Liz Truss’s leadership.

“There’s no doubt there’s a relief rally going on, that’s helping the pound,” said Ms Foley.

“Investors have more confidence in the new prime minister, and in his chancellor, than they did his predecessor.”

But Ms Foley added that the pound’s strength is also being driven by dollar weakness.

The US currency has been falling over speculation that the Federal Reserve might slow the pace of interest rate hikes.

Economic plan delayed

The new chancellor – who reversed almost all of Ms Truss’s tax cuts – will keep his job in the new cabinet.

On Wednesday, it emerged that his statement for the UK public finances will now be announced two weeks later than planned.

The economic plan was due next Monday, but will now take place on 17 November as a full autumn statement.

Mr Hunt said the delay would ensure it is based on the “most accurate possible” economic forecasts.

On Monday, Shevaun Haviland, director general of the British Chambers of Commerce, warned that the country “cannot afford to see any more flip-flopping on policies”.

“The political and economic uncertainty of the past few months has been hugely damaging to British business confidence and must now come to an end,” she said.