A sharp drop in energy prices, in particular petrol, is helping to ease cost-of-living pressures in the US.

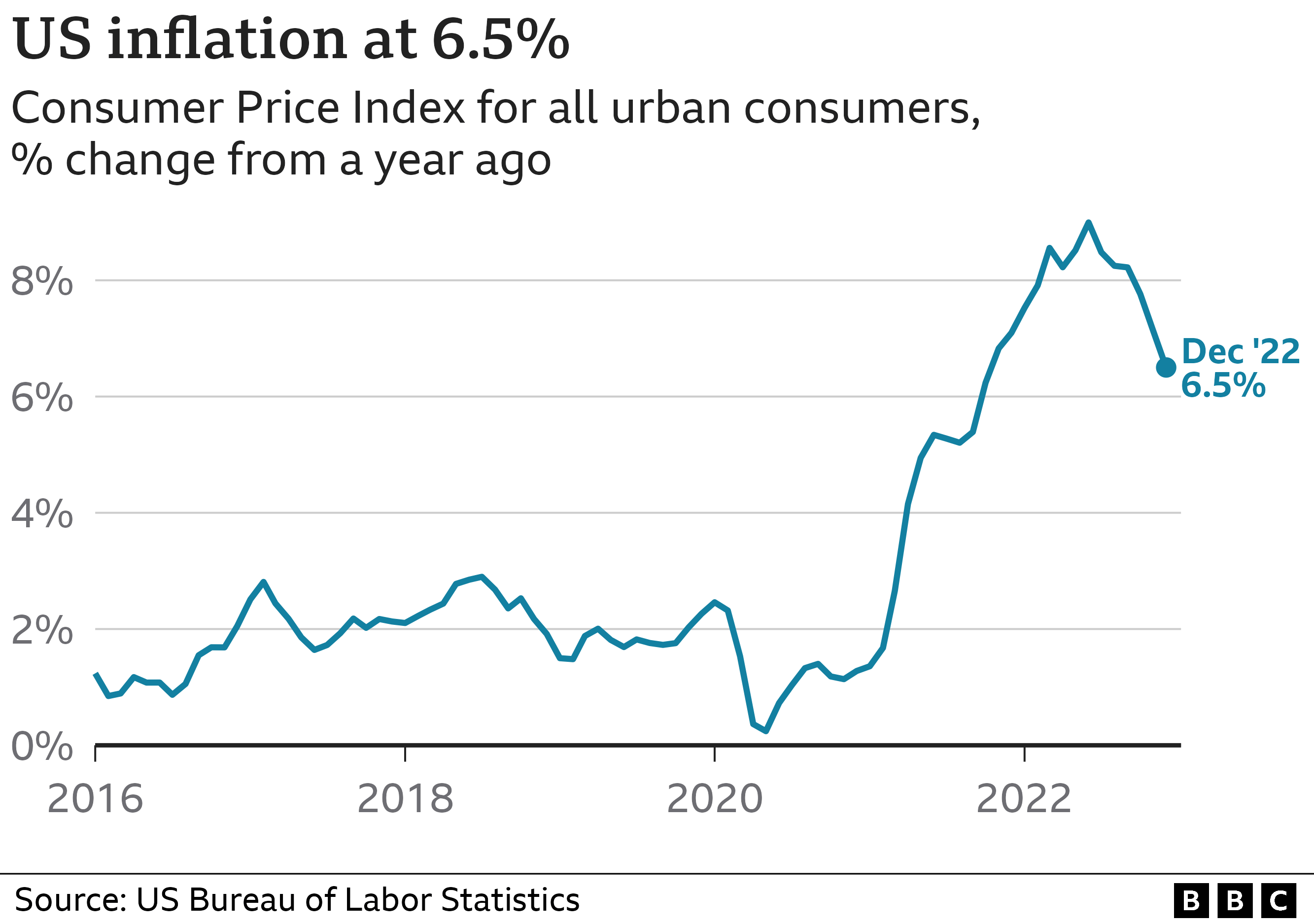

US inflation was 6.5% over the 12 months to the end of December, down from 7.1% in November, the US Labor Department said.

That was the smallest increase in more than a year, and marked the sixth month in a row that the pace dropped.

Some items such as oranges and bananas even saw outright price falls in December compared with November.

Overall, prices slipped 0.1% over the month, driven by the fall in petrol prices.

In remarks on Thursday, President Joe Biden celebrated the report.

“We’re clearly moving in the right direction,” he said. “It all adds up to a real break for consumers, more breathing room for families.”

But some analysts cautioned that the price relief was not spreading from energy to other items as quickly as hoped.

Clothing prices, for example, rose 0.5% from November to December, and were up 2.9% compared with a year earlier.

“Goods deflation isn’t broadening out quite as quickly as we expected,” wrote Paul Alsworth, chief North America economist for Capital Economics.

Federal Reserve inflation fight

Authorities in the US have been fighting to stabilise prices, which took off in 2021 as the economy roared back to life after pandemic lockdowns and companies facing shortages and rising costs hiked prices.

The war in Ukraine, which hit food and energy supplies, made the problem worse, sending inflation to 9.1% in June – the highest rate in more than four decades.

The US central bank responded last year, raising interest rates at the fastest pace in decades, in an effort to try to return inflation to the 2% rate it considers healthy.

Federal Reserve chairman Jerome Powell said last month that the bank would start to move less aggressively to see how the moves are playing out in the economy.

By boosting borrowing costs, the Federal Reserve is expecting to dampen demand for expensive items such as homes and cars, helping to slow the economy and ease the pressures pushing up prices.

Its fight is being closely watched, as the slowdown from higher rates also risk tipping the world’s largest economy into a recession.

Thursday’s report from the Labor Department showed prices for petrol were 1.5% lower in December compared with a year earlier. Costs for used cars and trucks also fell 8.8% year-on-year.

But Seema Shah, chief global strategist at Principal Asset Management, said the report was a “little underwhelming” and did little to clarify the path ahead for the bank.

“Taking a step back, evidence is building that inflation is cooling and will continue to do so over the coming months. But perhaps the real question will come in late Q2 as inflation tries to move below the 4-4.5% handle,” she said.

“If it plateaus there, then the Fed will have very little space to cut rates this year and markets will face renewed challenges. And if it falls steadily through that threshold due to growing economic weakness, permitting Fed loosening, markets will still be challenged due to earnings concerns. Not a great outcome, either way.”