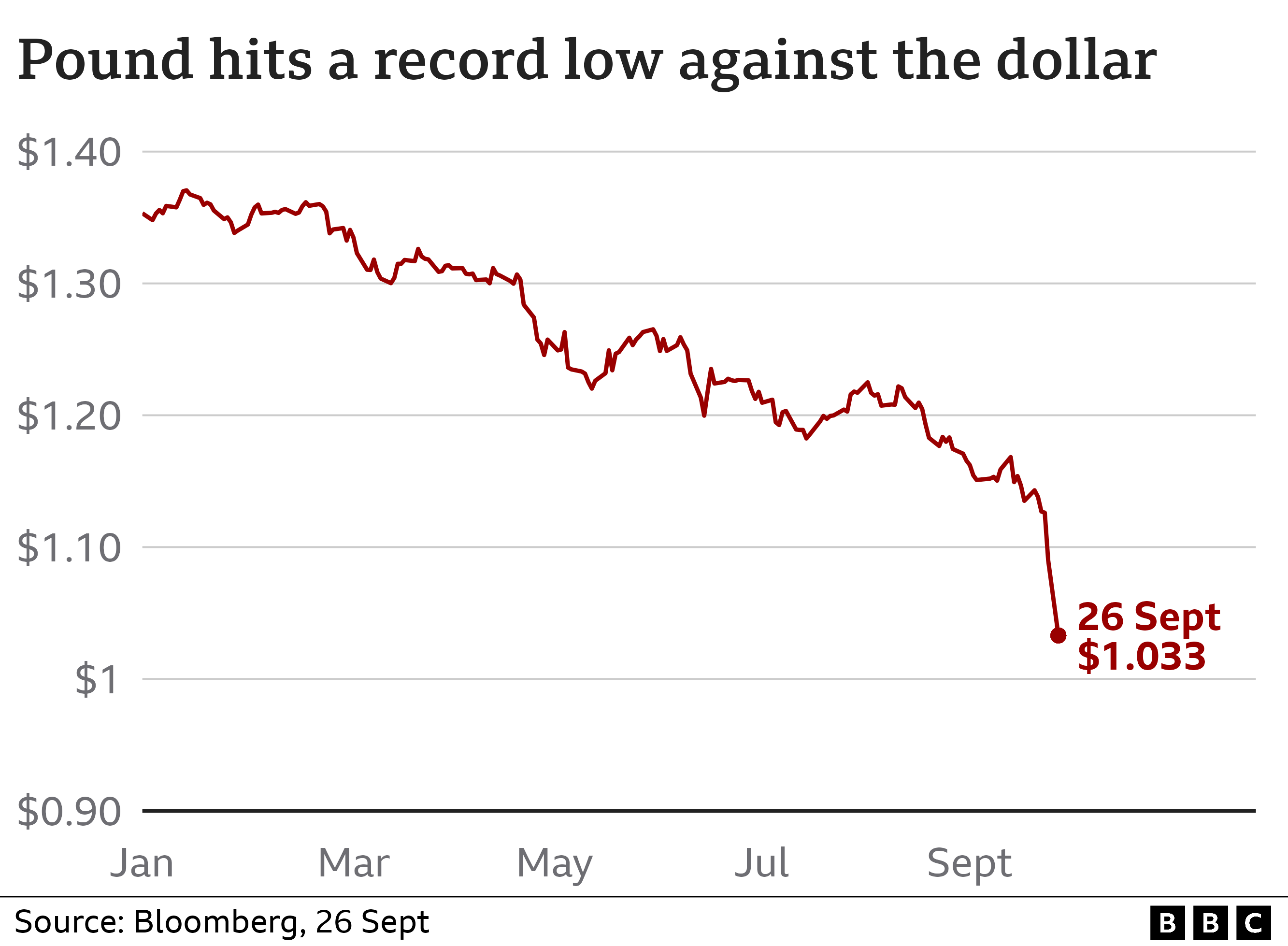

The pound has fallen to a record low against the dollar as markets react to the UK’s biggest tax cuts in 50 years.

In early Asia trade, sterling fell close to $1.03 before regaining some ground to stand at about $1.06 on Monday morning, UK time.

Chancellor Kwasi Kwarteng has promised more tax cuts on top of a £45bn package he announced on Friday amid expectations borrowing will surge.

The pound has also been under pressure due to strength of the dollar.

The euro also touched a fresh 20-year-low against the dollar amid investor concerns about the risk of recession as winter approaches with no sign of an end to the energy crisis or the war in Ukraine.

If the pound stays at this low level against the dollar, imports of commodities priced in dollars, including oil and gas, will be more costly.

Other goods from the US could also be considerably more expensive and British tourists visiting America will find that their holiday money does not go as far as before sterling’s slide.

There are also concerns that the tax cuts and a surge in government borrowing will stoke high inflation and force the Bank of England to raise interest rates even further. This would raise monthly mortgage costs for millions of homeowners.

Last week, the Bank raised interest rates by half a percentage point to 2.25% to try to calm inflation which is at a 40-year high of 9.9%. The rate increase was the seventh in a row and took rates to the highest for 14 years.

However, some economists have speculated that the Bank may call an emergency meeting as soon as this week to hike interest rates again ahead.

Market-watchers now forecast that interest rates could reach 5.5% by next spring.

Commenting on the likelihood the Bank of England could raise rates before its scheduled meeting in November, former Bank deputy governor Sir John Gieve told the BBC: “I’m sure they very much don’t want to do that… because that is a sign of pressure.

“A regular series of meetings at predictable times is part of the regime that we put in place when we made the Bank independent, so emergency meetings are avoided if at all possible and I am sure they will try to avoid it.”

On Monday, the cost of UK government borrowing surged again to the highest level since 2008 during the financial crisis.

At the weekend, Mr Kwarteng said “there’s more to come” in terms of tax cuts after announcing a massive shake-up of taxes on Friday during a “mini-budget” to boost economic growth.

Under the plans, which he hailed a “new era” for the economy, income tax and the stamp duty on home purchases will be cut and planned rises in corporation taxes have been scrapped. He said the government will get rid of the top rate of income tax of 45% for people earning over £150,000 a year.

As well as outlining £45bn in tax cuts, the government confirmed it would spend £60bn for the first six months of its scheme to subsidise rising energy bills for households and businesses. But that cost is expected to rise as the scheme to support households will last for two years. IMAGE SOURCE,REUTERS

IMAGE SOURCE,REUTERS

Shadow chancellor Rachel Reeves described the fall in sterling as “incredibly concerning”.

She added: “We need to hear from the chancellor his plans to get a grip on the public finances because that is what is giving real concern to market traders” and “working people”.

The Treasury refused to publish a forecast by independent watchdog the Office for Budget Responsibility on Friday on the UK’s economic outlook as well as future borrowing and debt.

BBC political editor Chris Mason said that while ministers were not saying anything publicly: “The impression I am left with is they want to ride this out. They hope it is short-term volatility. “

However, he said one Conservative MP told him: “This is very worrying. All the wheels could come off.”

Why the falling pound matters

Investors all around the world trade huge amounts of foreign currency every day. The rate at which investors swap currencies also determines what rate people get at the bank, post office or foreign exchanges.

Many people don’t think about exchange rates until it’s time to swap money for a foreign holiday. When you travel abroad, things will be more expensive if the pound buys less of the local currency.

However, a fall in the pound affects household finances too.

If the pound is worth less, the cost of importing goods from overseas goes up.

For example, as oil is priced in dollars a weak pound can make filling up your car with petrol more expensive. Gas is also priced in dollars.

Technology goods, like iPhones, that are made abroad, may get more expensive in UK shops. Even things that are made in the UK but from parts that are bought abroad can get much more expensive.

Some investors think the Bank of England could act as soon as Monday to halt the pound’s slide.

“To stop the bleeding even temporarily, the Bank of England may well enter ‘whatever it takes’ territory to bring inflation down. An emergency meeting rate hike could happen as soon as this week to regain credibility in the market. We could even see a hike today,” said Stephen Innes, managing partner at SPI Asset Management.

Paul Davies, chief executive at Carlsberg Marston’s Brewing Company, said the fall in the pound was “worrying” for the British beer industry, which imports hops from overseas. IMAGE SOURCE,PA MEDIA

IMAGE SOURCE,PA MEDIA

He said: “Many of the hops used in this country are actually imported and a lot of them, particularly for craft brewers, are imported from the US, so changes in currency is actually worrying for industry.

“Then of course people drink a lot of imported beers from Europe, and the euro vs the pound is also something we’re watching very closely at the moment.”