The US economy grew faster than expected in the third quarter of the year, helped by a tight jobs market and consumer spending.

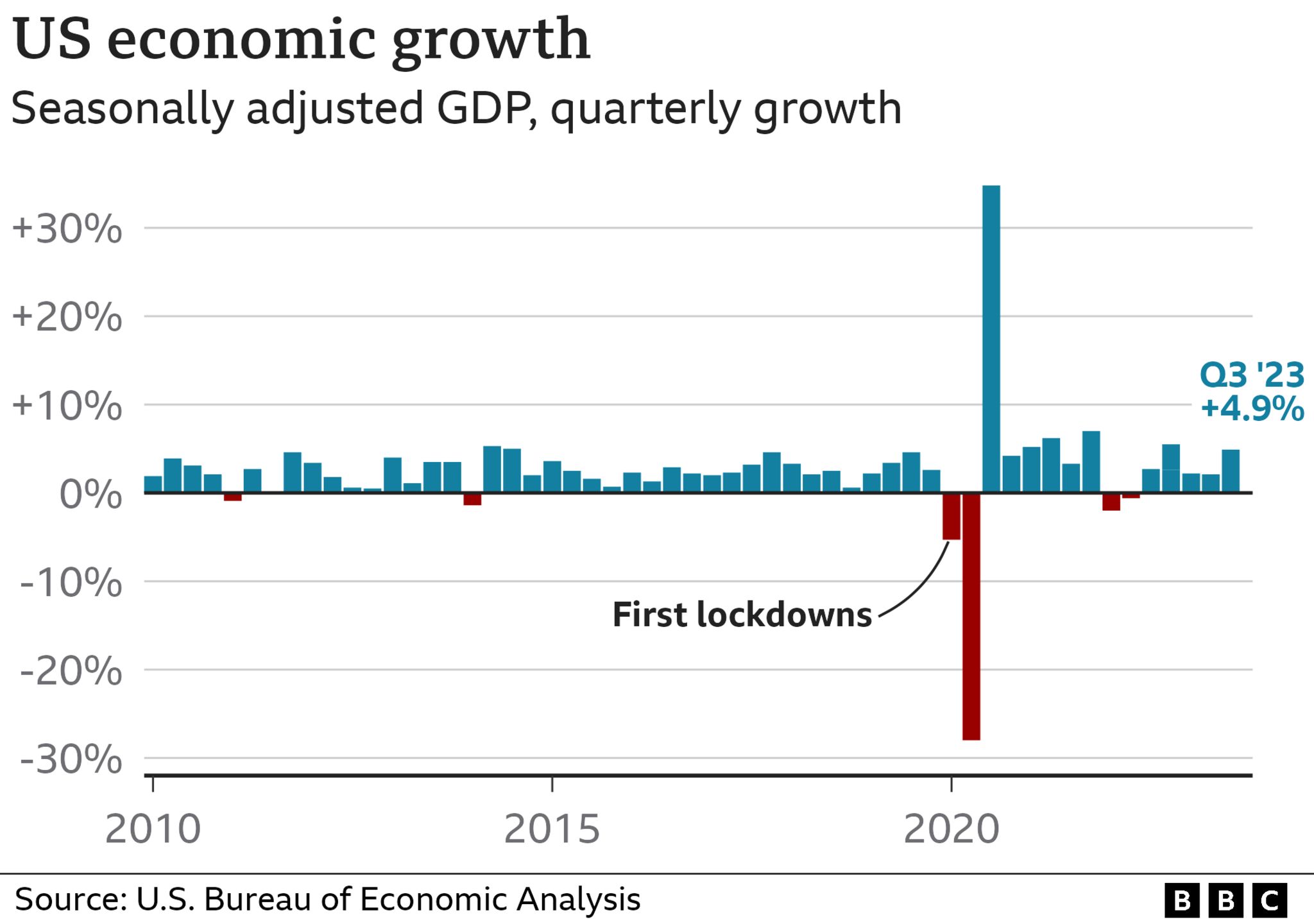

The economy expanded at an annual rate of 4.9% in the July to September period, according to the government’s first estimate.

It marked the biggest rise seen since the last three months of 2021.

Consumers spent a lot despite the Federal Reserve trying to clamp down on spending with higher interest rates.

Analysts expected that the economy would grow by 4.5% in the third quarter of this year.

But a strong jobs market meant that consumers were able to ask for bigger pay packets and keep spending on concerts, movies or holidays over the summer.

Consumer spending, which accounts for more than two-thirds of economic activity in the US, was the main driver behind the rise.

The latest figure is a big spike from the 2.1% growth seen in the three months to July.

In a statement, the US Bureau of Economic Analysis said the increase reflects “accelerations in consumer spending, private inventory investment, and federal government spending” among other factors.

It raises a question over previous predictions that the world’s biggest economy could possibly enter a recession.

The latest data comes ahead of a key meeting for the US Federal Reserve, where it will decide whether or not to raise interest rates again next week.

Some economists had raised concerns of an economic downturn being sparked by the central bank increasing rates to a 22-year-high in a bid to bring the rate at which prices are rising back down closer to 2%.

Raising interest rates is one of the key tools central banks use to try to tackle inflation. By making borrowing more expensive, the theory is consumers will spend less and lead to slower price rises.

So far, the world’s biggest economy has managed to defy the worst predictions.

But Nationwide chief economist Kathy Bostjancic said she expects that consumers are spending the “last portion of pandemic-related savings,” and that she expects growth will slow in the last three months of 2023.

Ms Bostjancic told the Agence France Presse news agency that the Federal Reserve may see the need for a further rate rise as it battles “sticky” inflation.

In a separate update on Thursday, the US Labor Department said that the number of people applying for unemployment benefits remains low.

However, in the final quarter of the year, growth might be hampered by strikes by the United Auto Workers, as well as the fact that student loan repayments by millions of Americans will have resumed, putting more pressure on their budgets.

The European Central Bank (EBC) alsoleft interest rates unchanged on Thursday as higher borrowing costs work their way through.

The ECB started increasing rates in July 2022, in response to rapidly rising prices.

After 10 successive rate rises, eurozone inflation, which peaked at 10.6 % in October 2022, has been falling steadily. It reached 4.3% in September.Although that means prices are still rising, the ECB has said the cost of borrowing is now high enough, and the effects of previous rises will continue to filter through.In a statement, the ECB’s governing council said inflation was still expected to stay “too high for too long”, but insisted rates were at levels that, if maintained for a sufficiently long duration, would make a “substantial contribution” to meeting its target of 2%.

Analysts said that although there were still some risks around the global economy from uncertainty in the Middle East and Ukraine, the focus was now moving towards the potential for rate cuts – with the Euro area economy currently stagnating.