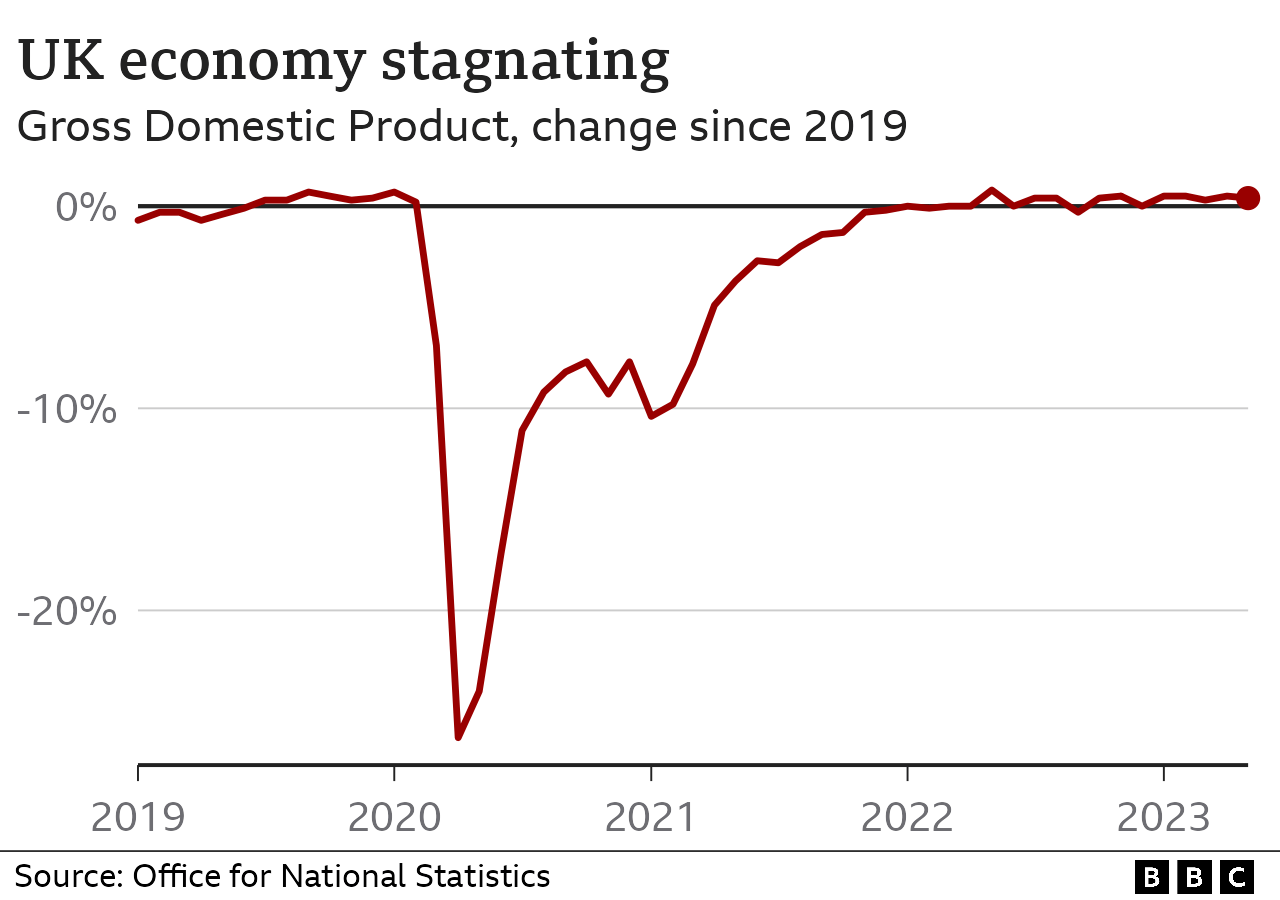

The UK economy has barely grown since 2019 before the pandemic, with one economist describing it as “listless”.

It shrank by 0.1% in May, partly due to the extra bank holiday for the King’s Coronation, which meant there was one fewer working day than normal.

The rising cost of living and higher interest rates have been squeezing households and businesses.

When an economy shrinks, people might lose their jobs and find it harder to get pay rises that keep up with prices.

Inflation – the annual rate at which prices rise – is at 8.7%.

The Bank of England has been putting up interest rates to try to slow price rises but this is having a knock-on effect on consumer borrowing costs, driving up mortgage and loan repayments for millions.

Chancellor Jeremy Hunt said high inflation was hitting the economy.

“The best way to get growth going again and ease the pressure on families is to bring inflation down as quickly as possible. Our plan will work, but we must stick to it.”

May’s decline in economic activity followed growth of 0.2% in April, the Office for National Statistics (ONS) said.

It said the manufacturing, energy and construction sectors fell, along with sales at pubs and bars.

But it said the health sector recovered while the IT industry had a “strong month”. Strikes also had less of an impact on the economy than in April.

The coronation – which meant there were three bank holidays in May, rather than the usual two – led to a slowdown in some industries, the ONS said, but benefited others such as those in arts and entertainment.

For most people, economic growth is good. It usually means there are more jobs and companies are more profitable and can pay employees and shareholders more.

The higher wages and larger profits seen in a growing economy also generate more money for the government in taxes.

It can choose to spend more on benefits, public services and government workers’ wages, or cut taxes.

When the economy shrinks, these things can go into reverse – but governments normally do still have a choice on public spending.

Capital Economics said that the 0.1% fall in May “isn’t as bad as it looks as some of it was due to the extra bank holiday for the King’s Coronation”.

It added that GDP – the official measure of the size of the economy – was on track to rise by around 0.1% in the three months to June.

“Our sense is that underlying activity is still growing, albeit at a snail’s pace,” said Paul Dales, its chief UK economist.

But Samuel Tombs, chief UK economist at Pantheon Macroeconomics, warned that May’s figures showed growth “remains listless”.

And Martin Beck, chief adviser to the economic forecasting group the EY Item Club, told the BBC’s Today programme that the “bigger picture is the economy remains weak”.

“It didn’t grow at all in the three months to May, and in May the economy was only 0.2% bigger than its size just before the Covid pandemic struck, so we’ve seen next to no growth since the end of 2019.”