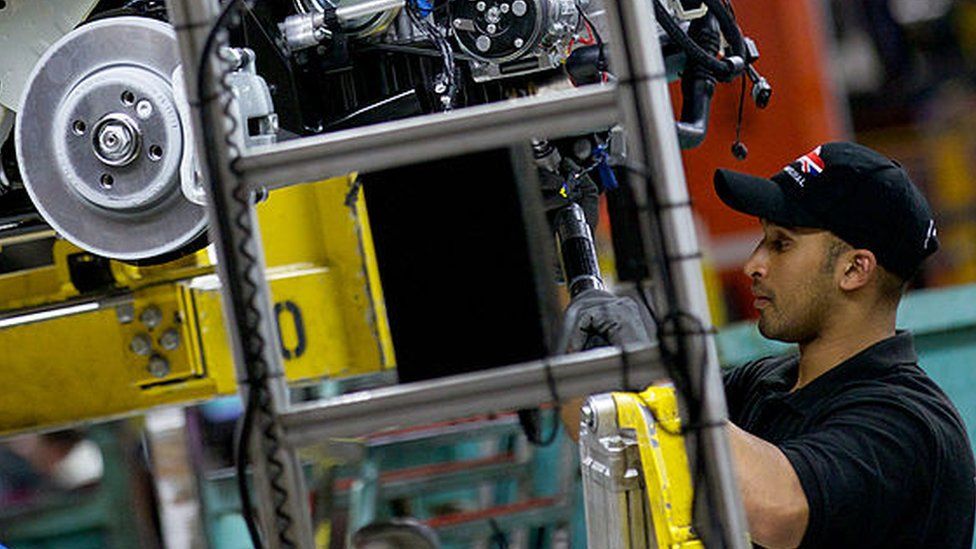

German car giant BMW is expected to announce plans to invest hundreds of millions of pounds to prepare its Mini factory near Oxford to build a new generation of electric cars.

Production of two new electric Mini models is due to begin at the plant in Cowley in 2026.

The move is expected to safeguard the future of the facility, as well as that of another factory in Swindon.

More than 4,000 people currently work across the two sites.

BMW is expected to say it will spend £600m on updating the Cowley plant, developing the production lines, extending its body shop and building a new area for installing batteries.

It also plans to build additional logistics facilities at Cowley and at the Swindon factory – which makes body panels for new vehicles.

This will allow two next-generation electric designs, the Mini Cooper and the larger Mini Aceman, to be built at Cowley alongside conventional cars.

A third electric model, the Countryman, will be made in Germany.

The UK investment will be backed by funding from the government’s Automotive Transformation Fund – understood to be worth £75m.

With the Mini brand expected to go fully electric by 2030, BMW’s decision is vital to the future of the two UK factories.

The first electric Mini was launched at the Cowley plant in 2019.

But last year, the company confirmed production of most of its electric cars would move to China, where the new models have been developed in partnership with Great Wall Motor.

At the time, BMW suggested that building both conventionally-fuelled and electric cars in the same factory was inefficient.

Now, that plan has clearly changed.

Production of the new models will begin next year at Great Wall’s factory in Zhangjiagang – with Cowley now expected to start building them as well in 2026.

Prime Minister Rishi Sunak said BMW’s investment was “another shining example of how the UK is the best place to build cars of the future”.

Business and Trade Secretary Kemi Badenoch told the BBC’s Radio 4 Today programme that the news was “exciting” and that it would ensure the sector “continues to be buoyant”.

When asked how much taxpayer money was being spent to secure BMW’s investment, she said: “All I can tell you is what we put in the automotive transformation fund, and that’s money that goes to many different companies across the sector not just one. We put in £350m in 2021.

“We do have to do some investment ourselves as government, that is standard, and we’re competing against countries from all around the world as well as the EU and we are winning. We’re not doing anything out of the ordinary.”

This is the latest in a series of government-backed investments designed to promote the development of electric vehicles in Britain, ahead of a ban on the sale of new petrol and diesel powered cars due to take effect in 2035.

In July, Jaguar Land Rover’s owner, the Indian group Tata, said it would build a giant “gigafactory” to produce batteries in Somerset, a project expected to benefit from hundreds of millions of pounds in taxpayer support.

Stellantis has just begun production of electric vans at its Ellesmere Port factory in Cheshire; Nissan is expanding output of EVs at its Sunderland factory, while its partner Envision AESC is building a gigafactory close by.

Meanwhile Ford is investing heavily in its Halewood plant, preparing it to build electric motors.

But there have also been setbacks for the industry in recent years, including the closure of Ford’s engine plant in Bridgend in 2020 and Honda’s Swindon factory in 2021.

In January, Britishvolt, which had been planning to build a battery factory near Blyth, collapsed into administration. The future of the site remains uncertain.

David Bailey, professor of business economics at Birmingham Business School, believes the BMW announcement will be “very good news” for the UK industry.

“The UK needs to shift towards EVs quickly. The 2035 deadline is approaching,” he says.

“It has been lagging behind other countries, not just in terms of battery production, but also in terms of EVs… but with the recent announcements, things are going in the right direction.”

What is not yet known is where the batteries for the cars to be built at Cowley will come from.

That could yet become a critical issue. From next year, new rules will effectively ensure that cars with batteries made outside either the UK or the EU will face steep tariffs when shipped across the Channel.

BMW is one of a number of businesses lobbying in the EU and the UK for those measures to be watered down or delayed.