Higher food prices may be here to stay, the Bank of England’s chief economist has said.

Huw Pill told MPs that the rate at which food prices are rising was expected to slow to “about 10% by the end of the year”.

But he warned a return to cheaper food was “something we may not be seeing for a while yet, if in the future at all”.

The price of food and non-alcoholic drinks rose by 17.4% in the year to June.

Over the last few months, the food inflation rate has gradually been dropping after hitting a high of 19.2% in March, according to official figures.

During a question-and-answer session with MPs on Monday, the economist admitted it was still not a “very comfortable level”.

It comes days after the Bank decided to raise interest rates for the 14th time in a row in a bid to increase the cost of borrowing, dampen demand and therefore slow price rises.

Inflation remains far above the Bank of England’s target of 2%.

Mr Pill said food price inflation had been “more long lasting than expected” and there had been “some hiccups” with bringing it down – notably the war in Ukraine and the export of grain out of the Black Sea.

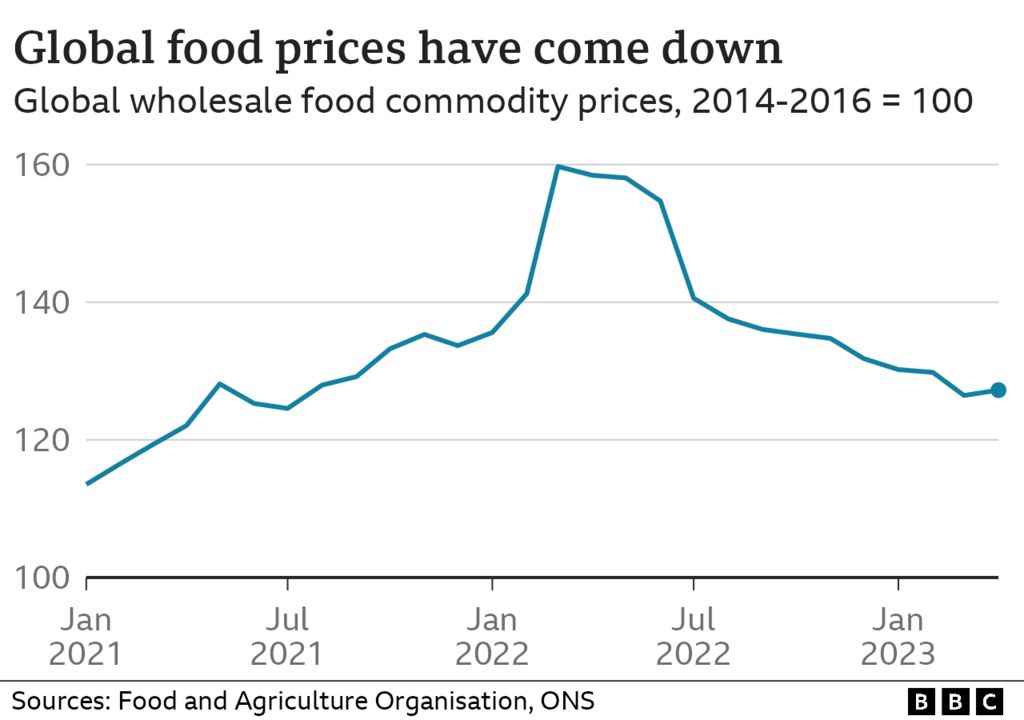

Global prices for certain commodities were starting to fall, Mr Pill said.

But he also claimed that some firms had locked in higher prices when the war in Ukraine had first started “in the face of uncertainty”, which had led to higher prices on the shelves.

Prices on eggs and milk were now beginning to fall, he added.

He said that shoppers would not see a sudden transformation of prices in the aisles, but may see a “gradual process”, with prices coming down slowly.

While he claimed the “direction of travel” was towards lower costs, he also said: “Unfortunately the days of seeing food prices fall, that does seem to be something that we may not be seeing for a little while yet, if in the future at all.”

Overall, shop prices were still 7.6% higher in July than the same time a year ago, according to the British Retail Consortium and Nielsen IQ.

Its boss Helen Dickinson also warned of possible supply chain issues on the horizon, due to rice export restrictions from India, for example.

In the last year or so, soaring food and energy bills have driven inflation up.

The last time the Bank’s chief economist spoke publicly, he stoked controversy by saying people should stop asking for pay rises to keep up with soaring prices because it risked keeping inflation higher for longer.

Mr Pill was rebuked by his boss, Bank of England governor Andrew Bailey, who said Mr Pill’s “choice of words was not right”.

Mr Pill later apologised for the “inflammatory” comments which suggested people must accept they are poorer.